New Release: Classy Pay Supports ACH and Continues Fight Against Fraud

Since we launched Classy Pay, our integration with Stripe’s and PayPal’s payment-processing capabilities, we’ve helped nonprofit customers save time and money on payment processing with easier payment reconciliation, low fees, automatic credit card updating for recurring gifts, and more benefits. However, we’re never content with the status quo and are always striving to improve our fundraising products.

That’s why we’re excited to announce that Classy Pay now supports ACH donations. While we dive into the details below, this update reflects not only our commitment to helping you offer an enhanced giving experience but also yet another layer in providing your nonprofit and your donors the highest levels of security. To paint the full picture, we take an in-depth look at how Classy Pay offers organizations the strongest protection against online payment fraud.

“We have seen zero fraud since the switch to Classy Pay and could not be happier.

The Nonprofit’s Challenge With Online Payments Fraud

Classy has been in the business of online fundraising for more than a decade, and in that time, we’ve gotten insight into the most common obstacles nonprofits face with online payment processing. One of the most stubborn challenges is the continual fight against online payment fraud.

It’s an unfortunate truth that online donation forms are very attractive to scammers. This is due to their simple, one-step checkout process and the ability to input any dollar amount into the donation form, unlike a traditional e-commerce website with set prices. We’ve seen this manifest in scammers or bots using online donation forms to run large batches of small donations attached to fake names and email addresses to test the validity of stolen credit card numbers.

For the nonprofit on the receiving end of these “donations,” this typically results in time-consuming audits and manually combing through reports to attempt to separate legitimate payments from fraudulent ones. Nonprofits can also be hit with expensive chargeback fees from the owners of the compromised credit cards, bad data in their donation platforms or CRMs, and perhaps most importantly, harm to donor trust.

To fight fraud, many payment processors and the nonprofits who use them currently rely on manually setting filters and rules for blocking fraudulent transactions and blacklisting individual IP addresses. Or worse, organizations rely on humans to regularly monitor all incoming payments to flag transactions as being potentially fraudulent. This can fail to prevent the full spectrum of fraud, as today’s scammers are increasingly sophisticated and often use fluctuating proxy IP addresses to make it look like their fraudulent transactions are coming from different computers each time or even from different countries.

This can result in a game of “whack-a-mole,” where organizations constantly create new filters or rules in their processor to block a source of fraudulent transactions, only to have a determined scammer bypass those rules and have the nonprofit end up right back where it started. Additionally, setting up too many manual filters means your organization runs the risk of blocking legitimate gifts from your donors, leading to a loss of revenue and frustration from donors who don’t understand why their gifts are failing.

How Classy Pay Protects Your Nonprofit From Fraud

This is to say that when we built Classy Pay, we knew security had to be front and center. One of the major factors that led us to decide to partner with Stripe to build Classy Pay was their Stripe Radar fraud protection product. Instead of using fraud rules set at the individual account level or human monitoring, Stripe Radar uses machine learning to automatically detect and block fraudulent payments in real time.

When a card is used to donate to a nonprofit organization using Classy Pay, there’s an 89% chance that that same card has been seen before on Stripe’s global payments network of millions of businesses. Data from that global network, as well as card blacklists from Stripe’s financial partners, is used to create a fraud score for each payment and evaluate the risk level.

This approach results in an average 25% reduction in fraud. We also see fewer false positives (legitimate donations falsely blocked as fraud).

We’ve already seen organizations that have switched to Classy Pay enjoying higher conversion rates on donation forms, thanks to this reduction in false positives. One organization saw more than $20,000 in gifts accepted that previously would have been falsely flagged as fraudulent.

“Classy Pay ended our fraudulent transactions and sped up our weekly reconciliation process. We always appreciate anything that puts time back in our day!

Classy Pay Now Supports ACH Donations

We’re excited by these early successes, but we’re not stopping here. Our product team is constantly focused on updating Classy Pay with new features to enable your donors to give exactly how they choose and make managing your fundraising even easier. Our latest update, available now, adds support for ACH donations on Classy Pay.

ACH, or Automated Clearing House processing, allows donors to make a gift to your organization directly from their bank account, without using a credit card. This giving method has a number of benefits, including supporting donors who don’t have credit cards, offering lower processing fees for large gifts, and even improving retention rates for recurring donors, as individuals tend to change their bank accounts much less frequently than they get a new credit card.

Did you know? Monthly recurring donors who give via ACH are retained for 20% longer, on average, than donors who give via debit or credit card.

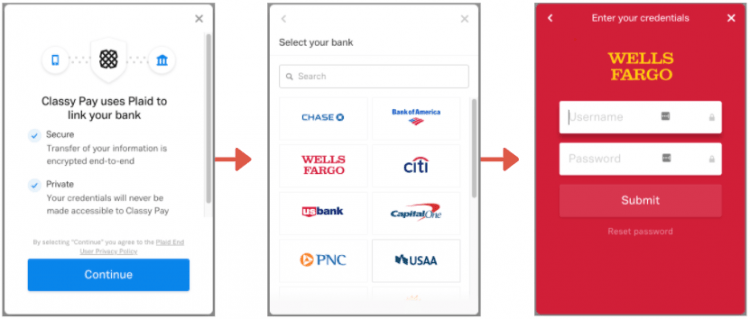

Of course, since donors who give through ACH are linking their payments directly to their bank accounts, it is even more important to make sure the payments are secure. That’s why we’re utilizing Plaid to authenticate and process ACH donations through Classy Pay. Plaid allows donors to safely and securely sign in to their online bank account directly from the Classy donation page, which provides an additional layer of protection for the donor’s bank account information.

We’re excited to roll out ACH payments to give organizations on Classy Pay—and their donors—even more flexibility to accept payments online. If you’re already a Classy Pay user, you can begin accepting ACH payments with just one click.

If you’re a current Classy customer not yet using Classy Pay, making the switch is simple. In just a few clicks, your nonprofit can see all the benefits of leveraging Classy Pay within your online fundraising ecosystem.

The work doesn’t end here. Our team has added support for digital wallet payments to Classy Pay, including Apple Pay, Google Pay, and Microsoft Pay. For the latest news about Classy Pay and other new features, make sure to check back on our blog or sign up for our product newsletter to stay in the know on all things Classy. For more information on Classy Pay, check out the Support Center.

Ready to Grow?

Subscribe to the Classy Blog

Get the latest fundraising tips, trends, and ideas in your inbox.

Thank you for subscribing

You signed up for emails from Classy

Request a demo

Learn how top nonprofits use Classy to power their fundraising.