How to Increase Member Giving to Your 501(c)(3) Church [4 Strategic Tips]

Cultivating member financial support is crucial to sustaining and growing your church. As a 501(c)(3), you benefit from tax-exempt status, but understanding how to encourage member giving is key to making the most of this advantage.

Below, we’ll explore the pros and cons of achieving 501(c)(3) church status, including the qualifications, rules for maintaining tax exemption, and strategic tips for increasing member generosity.

Are churches 501(c)(3) organizations?

A 501(c)(3) church is any religious organization with a tax-exemption status from the Internal Revenue Service or IRS. These tend to be places of worship, like churches, cathedrals, or chapels, that hold regular religious services. Unlike some other nonprofit organizations, churches don’t have to apply for tax exemption—if a church meets the Internal Revenue Code (IRC) requirements, it automatically receives this filing status.

This privilege allows donors to claim charitable deductions for any donations made to a church, even if that organization hasn’t sought (or received) official IRS recognition as a tax-exempt nonprofit.

Pros and cons of becoming a 501(c)(3)

A 501(c)(3) church designation comes with advantages and challenges. Understanding these pros and cons can help you make an informed decision about whether this status is right for your church. Here’s a quick breakdown of what to expect:

Pros

- Tax-exemption status: Your church is exempt from federal income taxes and property taxes.

- Tax-deductible donations: Your members can receive tax deductions for their contributions to your church.

- Financial transparency: Your tax returns are public, increasing transparency and trust in your organization. This transparency gives you an opportunity to demonstrate your church’s mission and impact without appearing boastful.

- Grant application: You can apply for and receive government (and nongovernment) grants limited to 501(c)(3) charitable organizations.

Cons

- Limited political influence: You can’t back political candidates, support political campaigns, or spend significant time or resources lobbying for the legislature.

- Financial disclosure: Publicizing every expense may feel nerve-wracking, but disclosing all your financial information can help improve transparency.

How to obtain 501(c)(3) church status

Here’s the short, step-by-step process for applying for 501(c)(3) tax-exemption status:

- Obtain an Employer Identification Number (EIN): Request an EIN from the IRS by submitting Form SS-4. You’ll need an EIN even if you don’t have employees (yet).

- File Form 1023: Submit IRS Form 1023 with your filing fee to the IRS.

- Wait for IRS approval: Wait for the IRS to review your application and send a determination letter with the status of your request.

Consider hiring a lawyer for legal counsel to help submit the documentation for your church. They’ll help expedite the process and get your 501(c)(3) determination letter as quickly as possible.

Rules for maintaining 501(c)(3) church status

Although your church may qualify for 501(c)(3) tax exemption, you must work to uphold the associated standards to maintain your tax-exempt status.

Participating in certain activities could cause you to lose your tax-exemption status, which means your members’ future contributions will no longer be tax deductible. That could greatly impact your potential members’ interest and ability to support your work.

Here are a few rules you must follow to maintain your 501(c)(3) church status:

- File your tax return on time: File an annual tax return (IRS Form 990). Failure to do so could jeopardize your tax-exemption status.

- Refrain from excessive lobbying: Keep in mind that 501(c)(3) churches can lobby for legislation but cannot “attempt to influence legislation as a substantial part of its activities” or “participate in any campaign activity for or against political candidates.”

- Manage finances responsibly: Don’t sacrifice your 501(c)(3) nonprofit corporation status by managing finances irresponsibly or benefiting private shareholders or individuals.

- Maintain the organization’s purpose: Remember your church’s purpose. Shifting to religious research or education won’t jeopardize your 501(c)(3) status, but you’ll no longer technically be a church. Thus, you’ll have to submit a formal 501(c)(3) application (and get approved) to qualify for tax exemption.

- Avoid illegal activities: Don’t compromise your church’s nonprofit status with illegal activity, financial or otherwise.

- Create bylaws: Implement nonprofit bylaws to help govern your qualified organization, establish rules for church leaders, and ensure you follow the right processes to protect your nonprofit corporation.

Strategic tips to increase member giving to 501(c)(3) churches

Your churchgoers already believe in your mission and likely want to be more active in your community. This creates a solid foundation for encouraging more member involvement.

However, member generosity extends far beyond financial contributions. It’s about providing them with opportunities to take the next step in their individual generosity journey. Let’s explore five ways your church can engage members more deeply.

Engage members with a mobile-optimized, branded donation page

Church shouldn’t be limited to Sundays, and neither should member engagement. As online church attendance continues to rise, members will likely want opportunities to give outside of a Sunday service.

A mobile-optimized, branded donation page makes it easy for members to stay connected with your church, no matter where or what device they use.

Classy Studio is an easy and flexible campaign builder that allows you to create fully branded giving pages that match the look and feel of your website. The drag-and-drop functionality and prebuilt layouts help your team confidently craft engaging giving experiences that balance conversion, tracking, and security without a single line of code.

Create a personalized member experience

A new member of your church doesn’t give in the same way as a lifetime member. Thus, your members deserve a giving experience that feels personalized and supports their spiritual journey.

With the right technology, you can build custom pages for new members and first-time givers and more in-depth pages for long-term givers. These customizable donation page options enable your organization to maximize each donor interaction by meaningfully connecting members to their giving, helping you reach your giving goals.

Another way to personalize the giving experience is through personalized ask amounts. Instead of displaying generic giving levels for everyone, Classy’s Intelligent Ask Amounts uses machine learning to predict how much a member is most likely to give and customize the ask to that individual.

Our technology uses a combination of data—like donor giving history, session data, nonprofit data, and more—to make personalized recommendations for each member. When A/B testing donation pages with and without Intelligent Ask Amounts, we found that those using the feature boosted giving revenue by an average of 11%.

Show members how they make a difference

In the past, church members didn’t think much about where their donations went. They were happy to tithe straight to a general fund. But now, donors—particularly younger ones—want to know where their money goes. The same default trust no longer exists.

However, the good news is that you can mitigate this easily by adding language about the impact of member generosity to your donation pages.

When members understand the specific ways you use their tithes—such as funding an outreach program, launching a campaign, or building a church plant—it reinforces their commitment to giving.

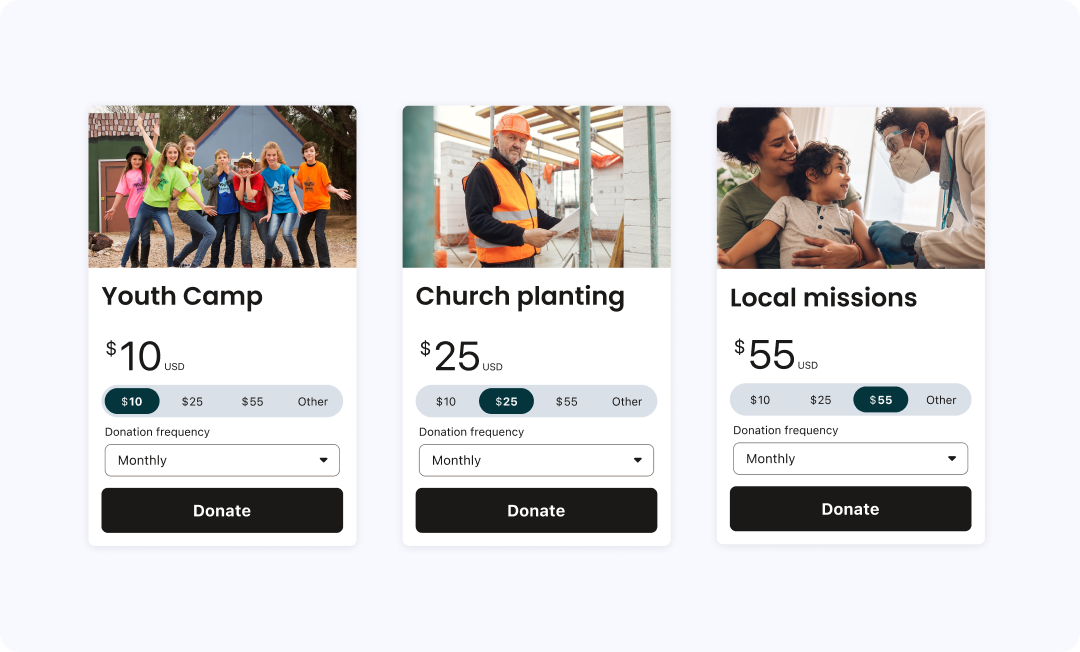

With Studio, you have access to powerful design tools that let you bring your stories to life in a way that resonates with your members. In particular, impact tiles show members the tangible impact of their generosity, letting them choose which programs they want to support.

Empower members to choose how to share their generosity

When a member chooses to give to your church, it’s a deeply personal expression of their faith. By providing them with the flexibility to decide how they want to show their support, you strengthen their connection and reinforce their commitment to your mission.

Here are some ideas to get you started:

- One-time donation: This type of support often helps a church meet specific campaign goals, such as expanding program areas, raising funds for a family in need, or supporting a church renovation project.

- Recurring giving: This type of support is for members who want to go the extra mile to support the church regularly. Recurring giving plans fill that desire and create a predictable stream of revenue for your church. Nonprofits that leverage Classy’s recurring donation platform, with tools such as embedded donation forms and in-form monthly giving upgrades, have experienced a 9x boost in supporter lifetime value.

- Peer-to-peer fundraising: This type of support is ideal for members passionate about spreading the gospel through their community and outreach.

- Volunteering: This type of support allows members to take a hands-on approach to engaging in your church’s mission, whether with Sunday services, community outreach, or church events.

Bring members together through community experiences

Creating opportunities for your church members to connect in meaningful ways is key to building a strong, close-knit community. While worship services are the heart of this, offering community experiences beyond Sunday gatherings can deepen relationships and create a sense of belonging.

To help organize these meaningful community get-togethers, Classy Live allows you to create custom event pages where you can easily accept registrations, sell tickets, and inspire attendees to fundraise leading up to the event.

If you host your event in person, we’ve got you covered there, too. You can share your event schedule with attendees before arrival, check in guests via the attendees’ menu or by scanning their mobile QR codes, and display live leaderboards to mobilize day-of donations via text-to-donate or paddle raise.

When you provide a mix of these experiences, you give members plenty of ways to engage, connect, and grow together, helping to build a vibrant and connected church family.

Learn more about how Classy can help your church unlock member generosity. Then, talk to a Classy expert to get started today.

Copy Editor: Ayanna Julien

Church giving made simple