The Impact of Diversified Online Payment Methods for Forward-Looking Fundraising

A transaction isn’t complete until the payment is processed. That’s why finding ways to simplify and diversify your nonprofit’s online payment processing can support your entire fundraising strategy.

When you offer people more ways to donate, you gain additional opportunities to hook supporters and entice them to share their generosity through online gifts, registrations, and recurring donations.

If you’re curious how methods like Venmo (U.S. only), PayPal, Apple Pay, Google Pay, ACH payments, and cryptocurrency can work for your nonprofit organization, you came to the right place. We’ll walk you through the benefits of each and how they can work together to support a flexible and personalized giving experience tailored to the next era of fundraising.

*Donations of cryptocurrency aren’t available through PayPal or Venmo.

So Why Collect Multiple Payment Types?

Everyone has their preferences about payment methods, with most people toggling between a few to navigate life’s expenses.

Classy’s Why America Gives report found that 77% of U.S. donors made financial changes to their lifestyles as a result of the state of the economy in 2022. That involves spending less while trying to save more, balancing bank accounts, adjusting payment methods, and altering billing schedules.

With a donation form or transaction page showcasing more payment options, you don’t have to worry about knowing which donors prefer. Instead, you can feel confident that any way a donor feels comfortable giving is there waiting for them when they’re ready to complete their gift.

Donors Expect More Payment Options

Our Why America Gives report also found that 20% of donors reconsidered donating when a nonprofit didn’t include their preferred payment option.

Donors are coming to nonprofits with modern expectations for the same simplicity they experience through money-sharing apps, auto-populated credit card information, and cloud password keychains that unlock login credentials with a face scan.

Flexibility Translates to Conversions

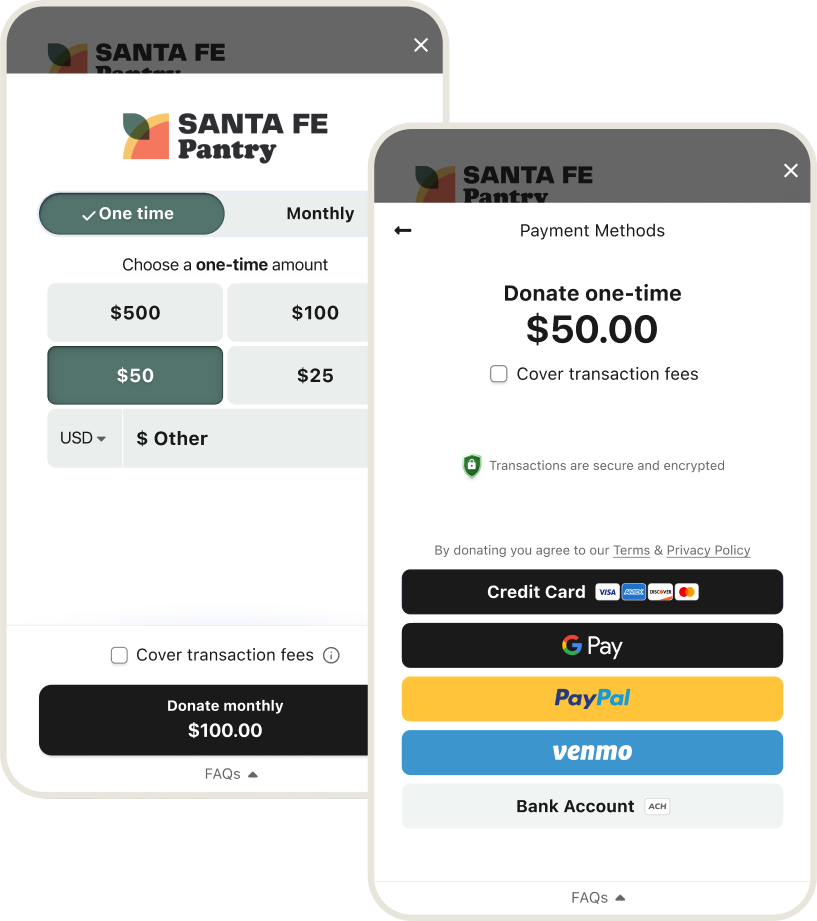

Classy Pay is a simple all-in-one nonprofit payment solution that offers everything from digital wallet payments to ACH, PayPal, and Venmo. Since launching, Classy has kept in touch with our customers to see how impactful flexibility and diversified payment options can be.

Our community uses Classy Pay across main donation buttons, campaign checkout pages, text-to-donate opportunities, event tickets, purchases or in-person donation collections, and more. Then, we consistently use the insights from their experiences to streamline the giving experience on Classy and meet today’s donors where they are.

Here’s what we found in our The State of Modern Philanthropy report:

- Nonprofits that use Classy’s fundraising platform and enable embedded donation forms with a wide array of payment options routinely see 2 times the industry average donation conversion rates and an average 29% increase in revenue per site visitor.

- The average one-time donation on Classy Pay is $189, nearly 1.5 times the average one-time gift not made on Classy Pay.

The versatility of Classy has been very beneficial for us. From donation pages, crowdfunding, recurring donation options, peer-to-peer fundraising, and the flexibility to pay with different payment options, we can tell our story and make it easier for our supporters to give.

Nonprofit Donation Processing Methods to Explore

PayPal Donations for Nonprofits

PayPal donations make giving more effortless than ever. It’s long been a way for users to buy, sell, and send money for over two decades and continues to innovate to meet the modern consumer. PayPal’s cumulative online transactions reached a record $1.36 trillion with 400 million active accounts at the end of 2022.1

Your nonprofit can inspire more donation activity through PayPal, thanks to the platform’s strong brand credibility. The average one-time transaction made with PayPal on the Classy platform is $114.2 Plus, 35% of all U.S. respondents who give recurring donations to one or more nonprofits use PayPal to complete those gifts.3

Results we love: The Food Bank for NYC team saw an overall conversion rate 3 times the industry standard when they added PayPal to their online donation forms, contributing to a 53% annual retention rate in 2022.

Read More About Their CampaignVenmo Donations for Nonprofits

Venmo for nonprofits is another popular payment app, expected to be used by 27.6% of the population by 2027.4 Thanks to its peer-to-peer model, users can send, receive, and hold money in an account for future use.

Often, friends, family, or co-workers use it to split costs without the hassle or complete impromptu purchases without a wallet nearby.

Nonprofits can tap into the power of Venmo donations to reach new donors as a natural extension of their daily routine. But does it drive engagement?

Classy customers saw mobile conversion improve by over 2 points after activating Venmo on Classy Pay.

Adding a payment method that feels modern and familiar can help improve conversion rates and donor satisfaction with simple payment reconciliation.

Results we love: The National Alliance on Mental Illness team transitioned to Classy Pay to give donors a simple way to use their preferred payment options, including Venmo and PayPal, and raised $256,000 in four months, with 82% of the donors new to the organization.

Read More About Their CampaignGenerosity Unlocked with Venmo This Giving Season

This Giving Tuesday, Classy teamed up with PayPal (Venmo’s parent company) to showcase innovative nonprofits like yours that make giving easy with simple payment methods. Donors filtered by the causes they care about through a dedicated Classy website to select a nonprofit, then used their Venmo account to do more good globally.

See the Latest ResultsGoogle Pay Donations for Nonprofits

Google Pay is a simple and secure digital wallet option offered by Google. The contactless payment option offers donors a more convenient way to complete a transaction on Android.

Cell phones and tablets are ubiquitous, which means mobile-friendly payment options, like Google Pay, bring the donation experience to an interface your supporters already engage with daily.

People don’t want to look for a physical credit card every time they donate, and they don’t have to, thanks to digital wallets that allow them to store that information safely on their phones.

More than half of the people surveyed by Forbes in 2023 say they’d stop shopping with a merchant that doesn’t accept payments from digital wallets.5

Results we love: The SeaLegacy team launched a campaign featuring multiple payment options, including Google Pay, just 24 hours before Giving Tuesday and raised 178% of their goal with a $92 average donation.

Read More About Their CampaignApple Pay for Nonprofits

Apple Pay is a digital wallet that simplifies credit card processing for iPhone, iPad, Mac, and Apple Watch users. It replaces their physical cards with a private payment method that they can set up in seconds using someone’s Apple ID and security features, like face recognition.

Without the extra steps, Apple Pay allows people to effortlessly use major credit cards, including American Express, Mastercard, Visa, and Discover.

If you don’t believe your nonprofit can reach more donors with Apple Pay, get this: Projections indicate that 67 million consumers will use the digital wallet by 2026.6 Meet the moment to gain support in a quick and user-friendly way.

Automated Clearing House (ACH) for Nonprofits

ACH bank transfers is another way to support donors who wish to ditch their physical wallets. This payment option can easily pull in saved bank account information to use on a donation checkout page.

It saves the extra step of grabbing a card to input data and ensures debit card expiration dates aren’t an issue if you set up a recurring donation through ACH.

ACH transactions are also reliable and make a big impact on nonprofits that rely on automated monthly donations from loyal donors. The State of Modern Philanthropy found that recurring payments on Classy are 29% higher on average with ACH than those made with credit card payments.

Results we love: The Massachusetts General Hospital team boosted fundraiser engagement and donation volume to raise $7 million a year with more options for donors to pay through Classy Pay, including ACH bank transfers.

Read More About Their CampaignCryptocurrency Donations for Nonprofits

Cryptocurrency donations are an ongoing discussion topic across the nonprofit sector. People can use it to purchase goods and services, and increasingly, it’s gained even more creative use cases, like those we’re seeing within fundraising.

Unlike money in a bank, cryptocurrency tokens are entirely digital and logged in a blockchain that decentralizes data by spreading information across multiple internet-connected devices.

Between the tax benefits of cryptocurrency and the security of every transaction, giving to charitable organizations this way is an option some donors prefer to lean on.

Airing on the side of early adoption for cryptocurrency donations offers a unique set of benefits since not every organization currently accepts crypto. There’s a prime opportunity for your nonprofit to build crypto giving into its donation pages now and promote it to donors who accumulate these alternative coins and seek a place to donate them.

Choosing Between Nonprofit Payment Processors

Nonprofits are innovative, so your online fundraising technology should be, too.

Here are a few questions to remember as you evaluate your options:

- Can I see transaction reporting, payout reporting, and processor management in the same place I run my fundraising campaigns?

- Can I customize the look and feel of the payment experience?

- Will there be consistency across all campaigns and donation forms?

- Do I feel good about the data security standards and fraud protection?

- Is it complicated to adjust on the back end?

- Is reconciling all payment types, currencies, and deposits simple?

When you choose a payment processor, consider the future of your mission, donor base, and goals. Considering generational preferences and existing donor information can help you design an experience that feels relevant and converts more gifts for your cause.

Give Donors More Choices with Classy

At Classy, we know how valuable the transaction process is in the overall giving experience. That’s why we created a way for nonprofits to make it seamless.

Classy Pay brings any payment option your donors may want directly to your donation form. The setup is simple to use alongside our platform of fundraising tools.

To get started or try on Classy Pay with your fundraising goals in mind, our team is on standby to help you get set up.

Copy Editor: Ayanna Julien

Article Sources:

- “PayPal Statistics,” CapitalOne Shopping Research, last modified September 16, 2023, https://capitaloneshopping.com/research/paypal-statistics/.

- Internal Classy Platform Data

- Logica Research (Commissioned by PayPal), March 23-April 2, 2021. Logica Research conducted an online survey that averaged 10 minutes among a sample of 4,306 PayPal user respondents from four countries (U.S., Canada, Australia, and U.K.) who made a monetary donation to a nonprofit PayPal merchant (N=478).

- “How Many People Use Venmo? (2023–2027),” Oberlo, accessed November 15, 2023, https://www.oberlo.com/statistics/how-many-people-use-venmo.

- “53% of Americans Use Digital Wallets More Than Traditional Payment Methods: Poll,” Forbes Advisor, last modified August 25, 2023, https://www.forbes.com/advisor/banking/digital-wallets-payment-apps/.

- “Apple Pay Statistics,” CapitalOne Shopping Research, last modified July 17, 2023, https://capitaloneshopping.com/research/apple-pay-statistics/.

Envision a Modern Payment Experience for Your Nonprofit