Why Your Donation Process Should Offer More Ways to Give

You could master a strategy to attract thousands of supporters to your campaigns, but it’s your donation process that determines if they complete a donation.

When it comes to converting supporters into donors, the payment options you offer matter. Nonprofits are embracing modern payment methods like digital wallets and Automated Clearing House (ACH) transactions. This helps organizations meet donors where they like to give with an easier checkout experience. They’re also reaping the many benefits of doing so.

We’re spilling the tea behind the transaction details that seem simple, but hold the power to transform your campaigns into a donation (and recurring donation) machine.

Here’s what you’ll take away:

- ROI proof points for digital wallets and ACH in the donation process

- Feedback and insights from nonprofits who use both effectively

- A quick checklist to put it all into action to modernize your donation process

Payment Options for a Modern Donation Process

In a world where we can order our favorite cereal instantly with a voice command and use facial recognition to authorize payments, giving back should be an intuitive checkout experience too.

Nonprofits can use both digital wallets and ACH on their donation pages to accept one-time and recurring donations.

How Can Nonprofits Use a Digital Wallet?

A digital wallet allows anyone to complete payment through their mobile phone. Information is stored in a secure application so no physical cash or card is required. It makes functionality like Amazon’s one-click purchase available for a wide variety of buying scenarios, including donations.

Popular digital wallets include Apple Pay, Microsoft Pay, and Google Pay. When you introduce digital wallets to your donation process, a donor can pay with a stored credit card on their phone. This eliminates the friction of entering a card number manually.

How Can Nonprofits Use ACH?

ACH is like an e-check. It offers another way for people to make an instant donation from wherever they are. Their banking information is already approved for automatic deposits. Forty percent of nonprofits fundraising online accept ACH direct debits.

Both of these payment options support the increased donor traffic nonprofits see from mobile devices.

How Digital Wallets and ACH Transform the Donation Process

1. Donors Receive a Simpler Giving Experience

The odds that a majority of your donors have used a digital wallet or ACH to complete a purchase in the last week alone are high. When you can match the payment experience today’s consumer is used to, it becomes easier for anyone to give to your cause. Donors can take action the moment they make the decision to check out your campaigns.

In the time a donor would need to pull out a physical credit card or mail a check, the likelihood of an abandoned campaign page goes up. Remove the risk by allowing for the payment methods that complement today’s digital lifestyle.

The Impact: The easier it is for donors to donate, the more likely they are to return to give for future fundraisers, talk positively about your organization to others, and even fundraise themselves on behalf of your cause.

2. Conversion Rates Increase

If your organization could increase your mobile conversion rate, wouldn’t you?

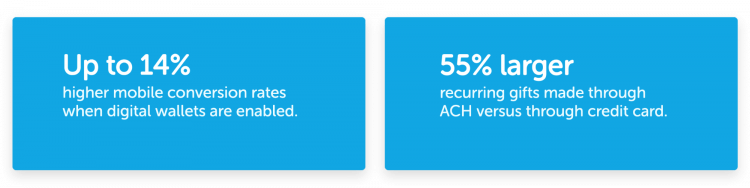

Our annual report, The State of Modern Philanthropy 2021 reveals the strong ROI our customers see by simply providing a quick and easy experience of donating through a digital wallet. This includes an increase in mobile checkout conversions by about 11 to 14% and a 55% larger recurring gift size.

The Impact: Higher conversion rates are a sign of donation pages that drive action and stronger return on your marketing time and cost investments to attract supporters.

Classy Customer Insight

“After adding a digital wallet option to our donation pages, we saw our conversion rate for mobile donors double.

3. Retention Among Recurring Donors Increases

How many recurring donors are lost because the form of payment they first signed up with has since expired? The answer may be higher than you think. Getting a new credit card is far more likely than getting a new bank account entirely.

Recurring giving programs are a key to sustainable revenue for all nonprofits. Yet 47% of nonprofits make no attempt to retain a recurring donation after a credit card is canceled. ACH pulls payments from a bank account. As a donor’s card expires or is suddenly replaced, you don’t lose their regular contribution to your fundraising efforts.

Monthly recurring donors who give via ACH are retained for 20% longer, on average, than donors who give via debit or credit card.

Classy Customer Insight

“There was definitely a benefit to switching over, especially moving sooner rather than later because ACH donations can help reduce churn, and the capabilities for processing were just greatly improved.

The Impact: The longer your recurring donors give to your cause, the more predictable revenue your organization has to build resilience in times of change or uncertainty.

ACH isn’t the only aspect of a recurring giving model that produces long-term financial benefits for your nonprofit. Check out the Ultimate Guide to Recurring Giving for an in-depth look at what works.

View the Ultimate Guide to Recurring Giving

4. The Risk of Fraud Decreases

Any payment experience opens the door to potential fraud. Options like digital wallets and ACH limit the risk your donors face. Better yet, they allow you to advertise a secure giving process as your top priority to ease their minds.

For example, many mobile payment processors can automatically detect and block fraudulent payments in real-time, so you don’t have to. Digital wallets like Apple Pay also add the security element of tokenization.

Donors using an Apple device can authorize every payment made through their digital wallet using their fingerprint or facial recognition. Their information is encrypted in the event that their phone is lost or stolen. This limits the potential for someone to get a card number, which is why many donors prefer to give this way.

While the inner workings of a digital wallet seem highly technical, all your nonprofit needs to do to reap the benefits is turn the option on, as Classy customers do with their Classy Pay option.

Read How Classy Pay Fights Fraud

The Impact: When you decrease the risk of fraud associated with your donation experience, donors are not only more likely to give again, but your brand reputation remains intact.

Classy Customer Insight

“We have seen zero, zip, zilch, nada fraudulent transactions since switching to Classy Pay and implementing Radar.

Your Nonprofit Reduces Payment Processing Fees

Nothing in life is free, but you should know all the ways you can save money in the process of raising it for your cause. Transaction fees presented to your organization seem small per donation. They do add up over the course of time and across all of your donors.

A traditional credit card transaction rate can hike up to 5% per swipe, according to NerdWallet. ACH donations are processed at a rate as low as 1% and 30 cents per transaction, as opposed to over 2% and 30 cents per transaction for credit card donations.

These lower fees make ACH payments ideal for event sponsorships, end-of-year donations, or any major gift.

The Impact: Lower fees added up over time result in more opportunity to allocate costs to impact-driving investments for your cause.

A Checklist to Modernize Your Payment Process

There are many nonprofit tools that bring your campaigns up to speed for donors who are on the go. This list of considerations will help you when you’re looking for the best fit for your organization.

When you’re evaluating your mobile donation experience, ask yourself:

- How quickly can a donor make a payment?

- Do I have the ability to accept payments through ACH?

- Can I reconcile payments and deposits from my fundraising platform?

- Am I able to receive payouts and cashouts daily?

- Do I receive timely notifications about payout reports?

- Can I customize the statement descriptors that appear on donors’ bank statements?

- Are fraudulent payments detected and blocked in real time?

- Will credit cards automatically update for recurring gifts?

- Can my processing fees be lower with new payment options?

By staying informed about what’s available to your organization, you’re already one step ahead. Download our complete Donation Page Checklist to optimize every element of your fundraising approach and convert more website visitors into donations for your cause.

The Nonprofit's Donation Page Checklist